Change in VAT rates in Switzerland as of January 1, 2024

From January 1, 2024, the following VAT rates will apply in Switzerland:

so far | new | |

Standard rate | 7.70% | 8.10% |

Reduced tax rate | 2.50% | 2.60% |

Special rate for accommodation services | 3.70% | 3.80% |

Detailed information on this can also be found at:

VAT Info 19 "Tax rate increase as of January 1, 2024

The VAT rate will be raised from 7.7 percent to 8.1 percent, the reduced rate from 2.5 percent to 2.6 percent, and the special rate for accommodation services from 3.7 percent to 3.8 percent.

Some questions cannot be answered comprehensively and generally in a white paper and depend heavily on the individual case and corporate structures.

If you have any further questions regarding VAT rates, please consult your tax advisor.

Together with him/her, you can check to what extent the tax rates need to be declared.

You can already create and use the new VAT rates in c-entron.

To do this, proceed as follows:

Create the following records under "Master data" -> "Value added tax."

- 8.1% from January 1, 2024

- 2.6% from January 1, 2024

- 3.8% from January 1, 2024

Important

The 0% VAT rate does not require any time limit in the form of an expiry date or a subsequent VAT rate.

0% remains 0% at this point.

Step-by-step preparations

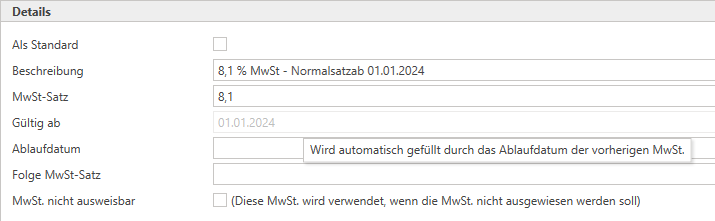

Apply VAT rate of 8.1% from January 1, 2024

Valid from: January 1, 2024 (filled automatically)

Expiration date: -

Consequence VAT rate: -

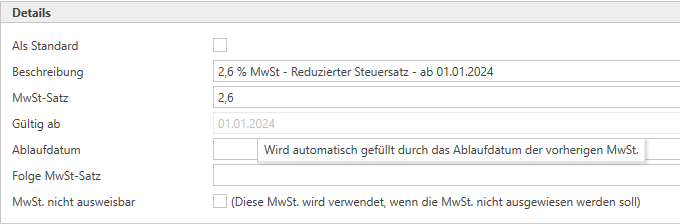

Apply VAT rate of 2.6% from January 1, 2024

Valid from: January 1, 2024 (filled automatically)

Expiration date: -

Consequence VAT rate: -

Apply VAT rate of 3.8% from January 1, 2024

Valid from: January 1, 2024 (filled automatically)

Expiration date: -

Consequence VAT rate: -

A "expiration date" and a "subsequent VAT rate" must be specified for each of the current tax rates

at 7.7% "Expiration date: December 30, 2023" and "Subsequent VAT rate: 8.1%

at 2.5% "Expiration date: December 30, 2023" and "Subsequent VAT rate: 2.6%

at 3.7% "Expiration date: December 30, 2023" and "Subsequent VAT rate: 3.8%

What needs to be done to ensure that VAT rates are adjusted as of January 1, 2024?

Following our adjustment in c-entron.NET with the 2.0.2006.x release, the articles no longer need to be overwritten. The "chain" (7.7% until December 31, 2023 -> followed by 8.1% from January 1, 2024) automatically applies the correct VAT rate in documents (taking into account the document date).

In addition, during the night of December 31, 2023, to January 1, 2024, the web service automatically "updates" the "expired" records with the follow-up records, provided these have been stored correctly.

The web service does not do this "automatically at the turn of the year." It checks daily whether a VAT rate is expiring and has a follow-up VAT rate, and then overwrites all items with the old rate with the new one on the expiration date. If the VAT rates have been set up correctly (i.e., the 7.7% rate ends on December 31, 2023, and is followed by the new 8.1% rate from January 1, 2024), the web service would then automatically "update" the rates for this reason.