Chart of accounts extension for (non-)customs-duty VAT.

If there is a lot of trade with foreign countries (EU and third countries), it is necessary to be able to post amounts to different tax codes.

It is currently possible to define separate revenue accounts for domestic/EU/third countries and reverse charge, and it is now possible to store the revenue/expense accounts in the VAT module of the chart of accounts so that they are included in the accounting export.

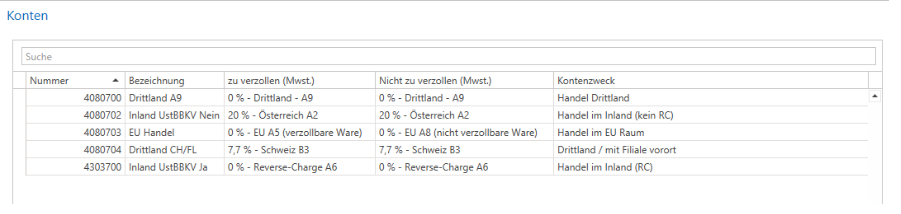

Chart of accounts module

In the "Chart of Accounts" module, VAT can now be stored for revenue/expense accounts:

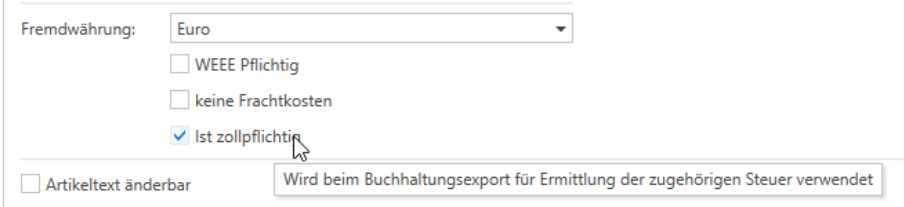

Product groups

The product groups and sub-product groups have been expanded to include the new setting "Is subject to customs dutythis setting is used for accounting exports.

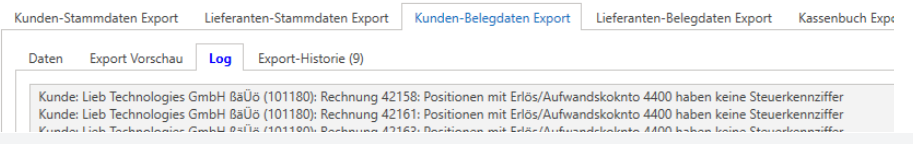

Accounting export

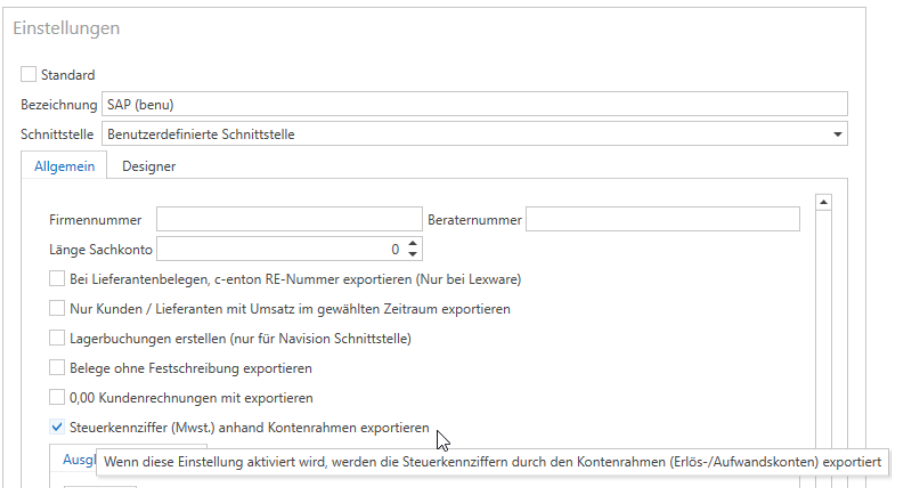

There is a new checkbox in the settings for the accounting export interfaces "Export tax code (VAT) based on chart of accounts".

This is currently only supported by the "Custom interface" interface type. If necessary, this can also be extended to other interfaces.

A new check for "user-defined interfaces" has been added to the accounting export. If there is no tax code for an entry, it is reported as an error.